Alex Khalil is a private lender & Mortgage Broker with Dominion Lending Centres - Mortgage Evolution - Want to see more articles like this one? Like my Facebook page - Looking for a mortgage or mortgage advice? Request a Call Or Apply Now.

There has been a lot of buzz around the Vancouver real estate market lately. Some feel the bubble is about to burst, some suggest the market will just keep going up and up, others feel any adjustment will be nominal.

One thing that we all can agree on is that real estate markets, like all markets, have natural cycles. That means that there will be a boom and there will be a bust, so the question we really should be asking ourselves is not IF the market will burst but WHEN. The correction is inevitable.

Of course no one has a crystal ball but we are now seeing multiple strong indicators of a market crash.

Here are 10 reasons why I think the real estate market is about to crash:

1) Extreme spike in property values

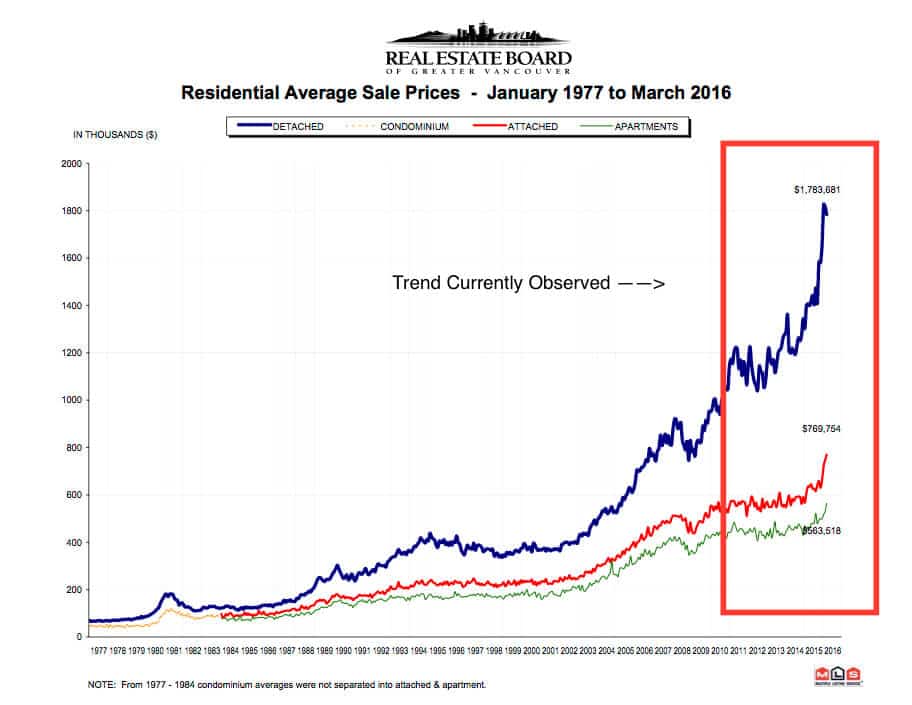

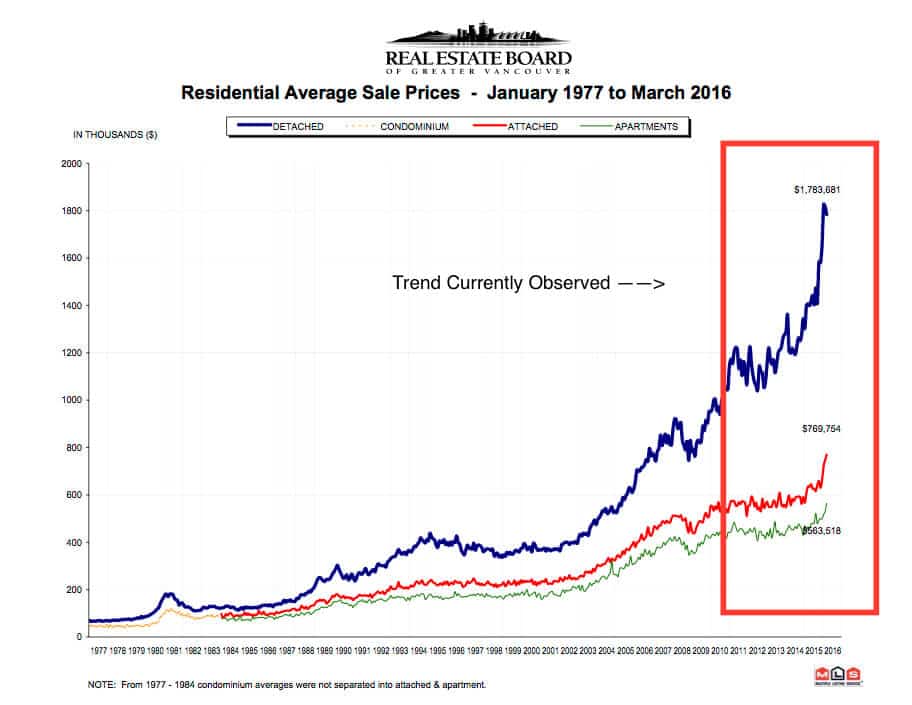

Yes, property values have been on the incline for some time and people have been crying ‘crash’ for a while, but there is one significant difference, the latest spike has been extraordinary. Have a look at the following graph released by the Real Estate Board of Greater Vancouver:

The significant spike in the last few months alone are a strong indicator of a correction looming. A strong and steady increase is healthy, but what we are now seeing are unsustainable gains, which more often than not is a strong indicator of a market on the verge of collapse.

2) Artificially low interest rates

The Bank of Canada is not lowering interest rates for no good reason. Aside from 2010, we have never seen such low rates. These historically low interest rates are intended prevent a crash. The problem with this approach is, as we know from the 2007/2008 US real estate crash is that sweeping things under the rug does not solve the underlying problem.

In fact, I am a firm believer the 2007/2008 US real estate crash would have had a significantly less adverse impact if the market had been allowed to follow its natural cycle.

Yes some government intervention is certainly necessary and beneficial to avoid another interest rate hike like the 80’s where we saw rates as high as 18%+, but what constitutes too much intervention? Banks are now selling bonds at negative interest rates. There is no more room for reduction in interest rates. To me this is a very strong indicator of a market crash.

3) 30 Billion Dollar Deficit in the 2016/2017 Federal Budget

Yes, you read that right. The Department of finance has projected the 2016/2017 Federal Budget deficit at a whopping -29.4 Billion dollars. The 2017/2018 budget is predicted to at a deficit of -29.0 Billion.

Compare that to the 2015/2016 Federal budget at a surplus of 1.4 Billion. Those figures certainly give a pretty strong indication of what is to come. No it doesn’t mean it is the end of the world but this staggering deficit is surely going to have a major impact on all major major Canadian markets, real estate included.

4) Decreased foreign investment

It is no secret that a significant amount of money from China has and continues to make its way into the Canadian real estate market. Many people believe that that the influx of Chinese money and investors will only increase as Vancouver is on the top list of safe places to harbour money. I have a different perspective on this, I believe that Vancouver is equivalent to the second home or RV which usually tends to be the first prized possession to go at the sign of bad times.

China has experienced one of the largest economic crashes of all time. What that means is a lot of Chinese investors are now feeling the pinch more than ever before. Pair that with significant over evaluation, some have estimated China’s debt as high as 5 trillion dollars. Now combine all of that with the fact that China’s over reaching government has turned up the heat on money leaving the country and ‘underground banks’ by tripling their efforts to stop the flow.

I am confident we are going to see a significant reduction in Chinese money entering the Canadian marketplace and no Canadian market will be more greatly affected by this slow down in Chinese capital more than Vancouver.

Recent trends are showing many Chinese investors selling or attempting to sell their Canadian real estate holdings or significantly leveraging real estate at higher percentages than ever before.

If all that isn’t enough, the Chinese media is warning of a major crash in the Canadian real estate market, advising Chinese nationals to be cautions and to get out of the Canadian real estate market at all costs. Some may suspect a portion of these advertisements could be government influenced intended to slow the flow of money leaving China, but does it really matter? If even 20% of those foreign investors jump on the band wagon that in and of itself is cause for major concern.

5) A market correction has already started

Single family home values in the Greater Vancouver Area, according to many real estate professionals I have spoken to recently, including many real estate appraisers, have now started to take a small dip. This is a stark contrast to the bidding wars we were seeing as little as two months ago. In fact, some sellers are not seeing competing offers at all.

According to the Real Estate Board of Greater Vancouver, the number of sales of single family homes has now dropped 19 percent. As much as 36 percent on the Vancouver’s west side.

The number of sales to listings have decreased from 72 sales per 100 listings in the first six months of 2015 to 58 sales per 100 listings in the first six months of 2016.

Some may argue that this is just simply evidence of a ‘small’ correction and that may be true. The problem is that there are a number of savvy real estate investors and homeowners who are sitting and waiting for the peak of the market before ‘getting out’. This minor slow- down may not seem like much on the surface, but it has all the ingredients to cause a wide spread panic. As soon as these speculators get wind of the possibility of a down turn it may just be too late. It could be too soon to tell, but a minor slow-down is usually a clear indicator that things could start to go south.

Alex Khalil is a private lender & Mortgage Broker with Dominion Lending Centres - Mortgage Evolution - Want to see more articles like this one? Like my Facebook page - Looking for a mortgage or mortgage advice? Request a Call Or Apply Now.

6) Fraudulent mortgages

One can only speculate, but the probability of fraudulent mortgages in the marketplace is extremely high. Consider for a moment that the median individual income reported by stats Canada for Vancouverites is $76,000 and the average benchmark home price in Vancouver Region (not just the City itself) according the Greater Vancouver Real Estate Board is currently hovering around 1.4-Million.

Based on current mortgage rates and qualification requirements, a 20 percent down payment (minimum for mortgages above 1-Million) and zero debt and perfect credit, a person would need to earn $162,500 per annum to qualify for that size of a mortgage. Even with two median income earners in the home that still would not be enough income.

Of course there are exceptions. Those who owned their properties prior to the surge in prices, those that have above average income, those who have larger than life down payments and those who rely on non-traditional or private financing but those are few and far between.

Either way you slice or dice it, what that means is that Vancouverites, particularly those who have bought recently are highly over leveraged, under qualified or into some really expensive mortgage debt. All of that is fine, as long as the market keeps going up and up, but at the first sign of a decline many of those property owners could find themselves in very hot water.

7) Big players betting against the market

I am sure by now most of you have heard about Marc Cohodes, the multi-billion dollar fund manager and Wall Street legend who came out of retirement to short Canadian Real Estate vis-à-vis Canadian Home Capital Group (HCG), a ‘B’ mortgage lender with an impressive Mortgage portfolio exceeding 20 Billion dollars.

HCG admitted to inadvertently underwriting 1.9 Billion dollars in fraudulent mortgages last year alone, but Cohodes isn’t the only one betting against Canadian real estate. Rumours have it that a number of other funds are also betting against Canadian real estate.

What we are also now seeing are senior bankers and major players in both the private and government financial sectors selling their own personal real estate and getting out of the Vancouver and Toronto real estate markets. Pair that up with the fact that two of the five major Canadian banks, TD Canada Trust and Scotiabank, have now officially to paraphrase Scotiabank Chief Executive Brian Porter, ‘taken their foot of the gas’ when it comes to mortgage lending in both Vancouver and Toronto.

8) Vancouver is such an amazing city and has the best weather in Canada!

I couldn’t agree more. I love Vancouver!

I am hearing this more and more these days whenever the topic of the real estate bubble comes u. The problem is that as nice and desirable of a city is Vancouver really is, that is not a sound financial indicator and does not make it immune to market cycles. Caracas and Florida are both beautiful places to live, but that doesn’t guarantee the real estate prices or make real estate markets immortal, and yes, I completely agree that in the long term, all of those reasons will play a significant factor in Vancouver’s positive migration and by no means am I saying that Vancouver will never recover, but the reality is we may very well be in for a bust in the short run, at least until the market catches up to other global markets at a steady and natural pace. If anything when people start telling me that the reason the Vancouver’s real estate is going to continue to sky rocket is because of the weather, the alarm bells sound louder then ever before.

9) Regulators tighten the reigns

“Persistently low interest rates, record levels of household indebtedness, and rapid increases in house prices in certain areas of Canada (such as Greater Vancouver and Toronto) could generate significant loan losses if economic conditions deteriorate” - one of the warnings issued recently by the Office of the Superintendent of Financial Institutions (“OSFI”) to financial institutions across Canada.

The Canadian Mortgage and Housing Corporation (“CMHC”) also warned earlier this year of ‘strong evidence of overevaluation’ in the Vancouver housing market.

This all comes in the wake of a recent announcement by the Provincial government that the Real Estate Industry in British Columbia’s ability to self-regulate has been forthwith revoked.

The Bank of Canada recently released a report that calls the rapid growth of home prices in Vancouver ‘unsustainable’, saying the potential for a downturn in prices is becoming likelier.

10) Natural market cycle

I touched on this briefly at the beginning of this article. One of and if not the most important factors we cannot ignore is that all markets go through a natural cycle. In its simplest terms, a market booms, busts, recovers and repeats. That leaves us in no other spot then at the end of that cycle. There is no real question of what is coming next, only when.

Somehow, history continues to repeat itself, most people seem to get amnesia and forget what happened last go around. Everybody gets caught up in the hype. ‘Get in now before it’s too late’ and turn a blind eye to the risks associated with a market crash.

Those on the sidelines, not in a position to buy due to soaring house prices, might want to turn that frown upside down, because believe me, history is about to repeat itself in a big way.

As a mortgage broker I am really adverse in interest to write this article, the more people that buy, the more mortgages are originated, but regardless the impact on my industry, the bubble is about to burst and the writing is on the wall in neon letters.

Some argue that they could ride out the storm, that they have seen such huge gains that a correction of say 30% wouldn’t affect them that much. That may be true, but if you are ahead of the game, you’ve tripled or quadrupled your money, isn’t now the time to pick up your chips and cash out?

Take quick look back at the last two crashes in our real estate market and you will see that in both cases the bust was nearly as big as the boom. The longer the cycle and the bigger the boom, the bigger the crash. Particularly so in a market that has been artificially manipulated by non-organic interest rates.

Some might argue that the bungee cord has been stretched farther than ever before, so pick wisely which side of the bungee cord you want to be on when it snaps back.

Alex Khalil is a private lender & Mortgage Broker with Dominion Lending Centres - Mortgage Evolution - Want to see more articles like this one? Like my Facebook page - Looking for a mortgage or mortgage advice? Request a Call Or Apply Now.

Alex Khalil is a private lender & Mortgage Broker with Dominion Lending Centres - Mortgage Evolution - Want to see more articles like this one? Like my Facebook page - Looking for a mortgage or mortgage advice? Request a Call Or Apply Now.

Alex Khalil is a private lender & Mortgage Broker with Dominion Lending Centres - Mortgage Evolution - Want to see more articles like this one? Like my Facebook page - Looking for a mortgage or mortgage advice? Request a Call Or Apply Now.